Both the House and the Senate versions of the Tax Cuts and Jobs Act (TCJA) included a 20% proposed corporate tax rate. Recently that number was adjusted to 21%, as lawmakers from  both the House and Senate made progress in consolidating the two versions into a single bill. While a 21% corporate tax rate is appealing, the impact is not quite as broad as it may appear when you consider the effective tax rate across the S&P 500.

both the House and Senate made progress in consolidating the two versions into a single bill. While a 21% corporate tax rate is appealing, the impact is not quite as broad as it may appear when you consider the effective tax rate across the S&P 500.

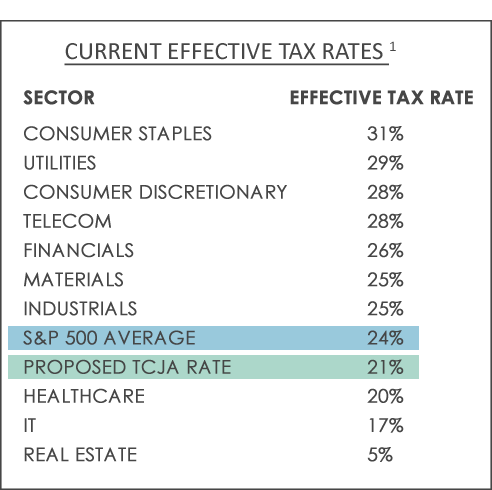

As the chart illustrates, the average effective tax rate of S&P 500 companies today is 24%, not significantly above the proposed rate in the TCJA and well below the current corporate tax rate of 35%. That said, some sectors do pay something closer to the 35%, and those stand to benefit more from the reduced corporate rate proposed in the bill.

For a more in-depth look at the potential winners and losers under the tax plan, read our full tax reform commentary on Harvest: Tax Reform in Focus: 6 Key Elements of the Tax Plan